What can we learn from CFPB's Annual Report for 2023

The Consumer Financial Protection Bureau has released its annual report analyzing complaints submitted by consumers in 2023. The report highlights trends found among more than 1.3 million complaints, which the Bureau sent to more than 3,400 companies for review and response.

Major findings include:

- A continued increase in complaints about Credit or consumer reporting.

- Debt collection is the second most common complaint type, with the Consumer Financial Protection Bureau sending companies nearly 70,000 debt collection complaints.

- Student loan borrowers reporting persistent difficulties in accessing customer service, delays in refunds for payments made during the coronavirus (COVID-19) payment pause, processing delays when attempting to access different repayment programs, and problems with qualifying payment counts for forgiveness programs, among other issues.

The elephant in the room

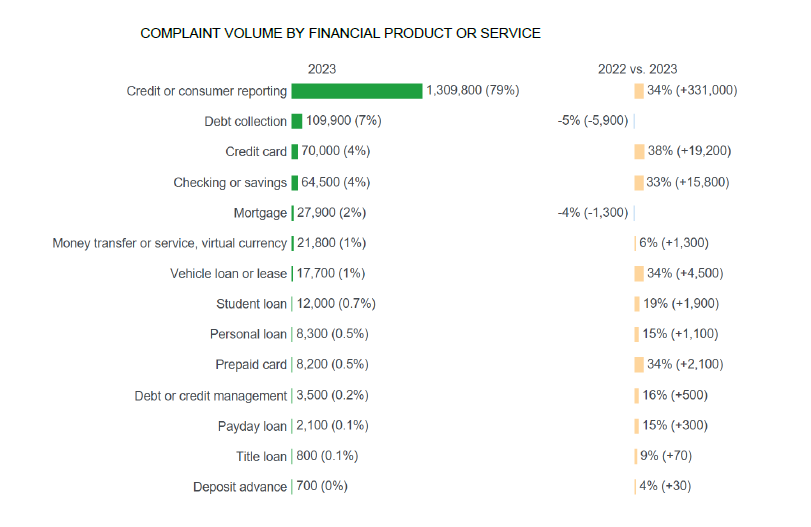

Credit or consumer reporting is the bulk of the complaints, comprising 79%. Collectively, credit or consumer reporting, debt collection, credit card, checking or savings account, and mortgage combined account for 96% of the complaints the CFPB received in 2023.

Compared to 2022, below is the percentage of increase in complaints compared to 2023

- 34% increase in complaints for Credit or consumer reporting

- 38% increase in credit card

- 33% increase in checking or savings

- 34% increase for vehicle loan or lease

- 34% for prepaid card

- 16% debit or prepaid card management

- 15% payday loan

Incorrect information in your report is the most common issue for credit or consumer reporting

The CFPB received approximately 1,309,800 credit or consumer reporting complaints in 2023. The CFPB sent 1,095,300 (84%) of these complaints to companies for review and response, referred 2% to other regulatory agencies, and found 15% to be not actionable.

Companies responded to 99.8% of credit or consumer reporting complaints sent to them for review and response. Companies closed 48% of complaints with an explanation, 47% with non-monetary relief, and 0.1% with monetary relief.

Georgia is the most complained state in the United States

Per capita, the CFPB received more complaints from consumers from Georgia than anywhere else in the United States, followed by consumers in Florida, D.C., Delaware, and Nevada.

Is veteran debt assistance real?

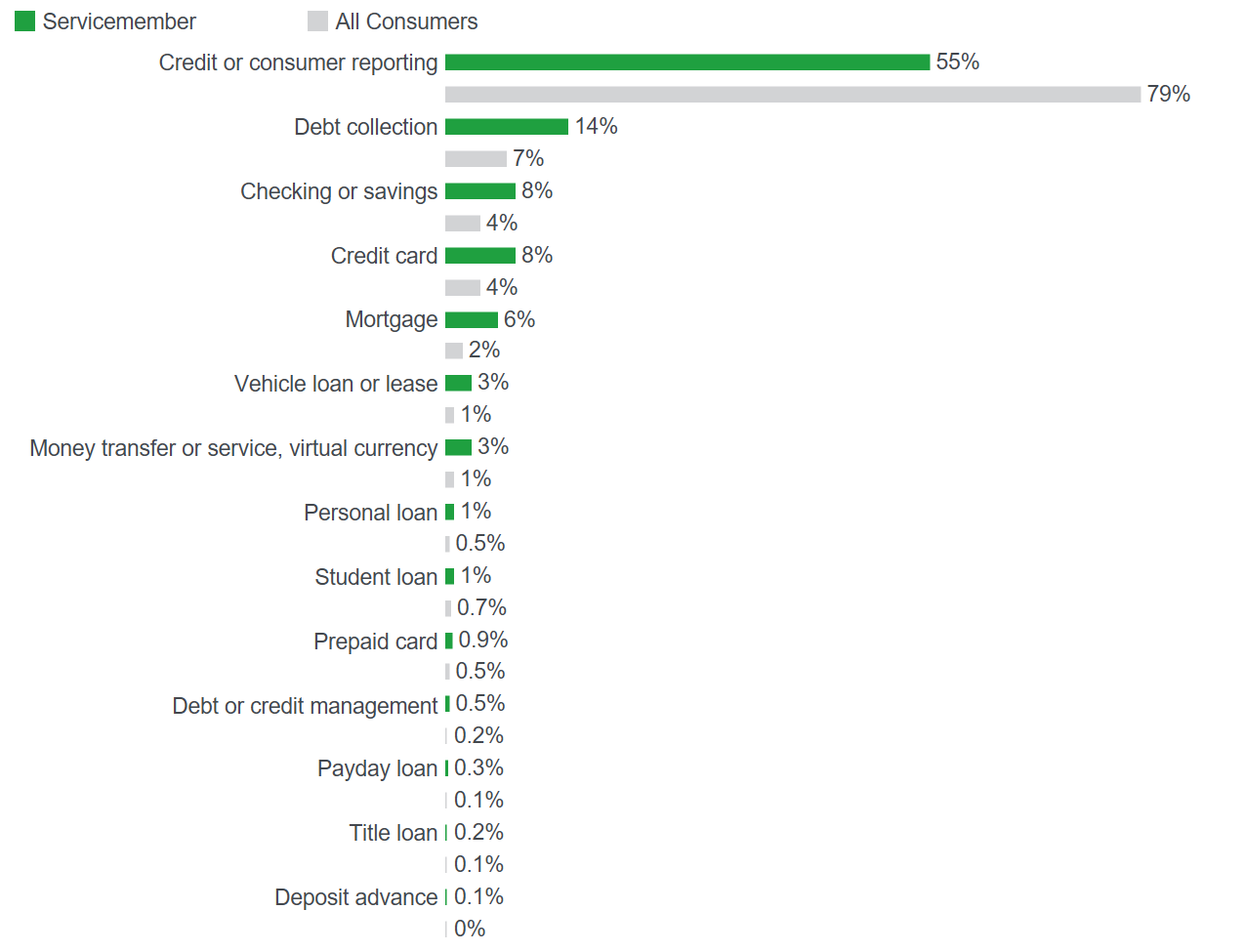

It seems service members, veterans, and military families still feel the pain when availing of financial services. Credit reporting concerns are also particularly challenging for servicemembers who rely on accurate credit reporting to maintain security clearances.

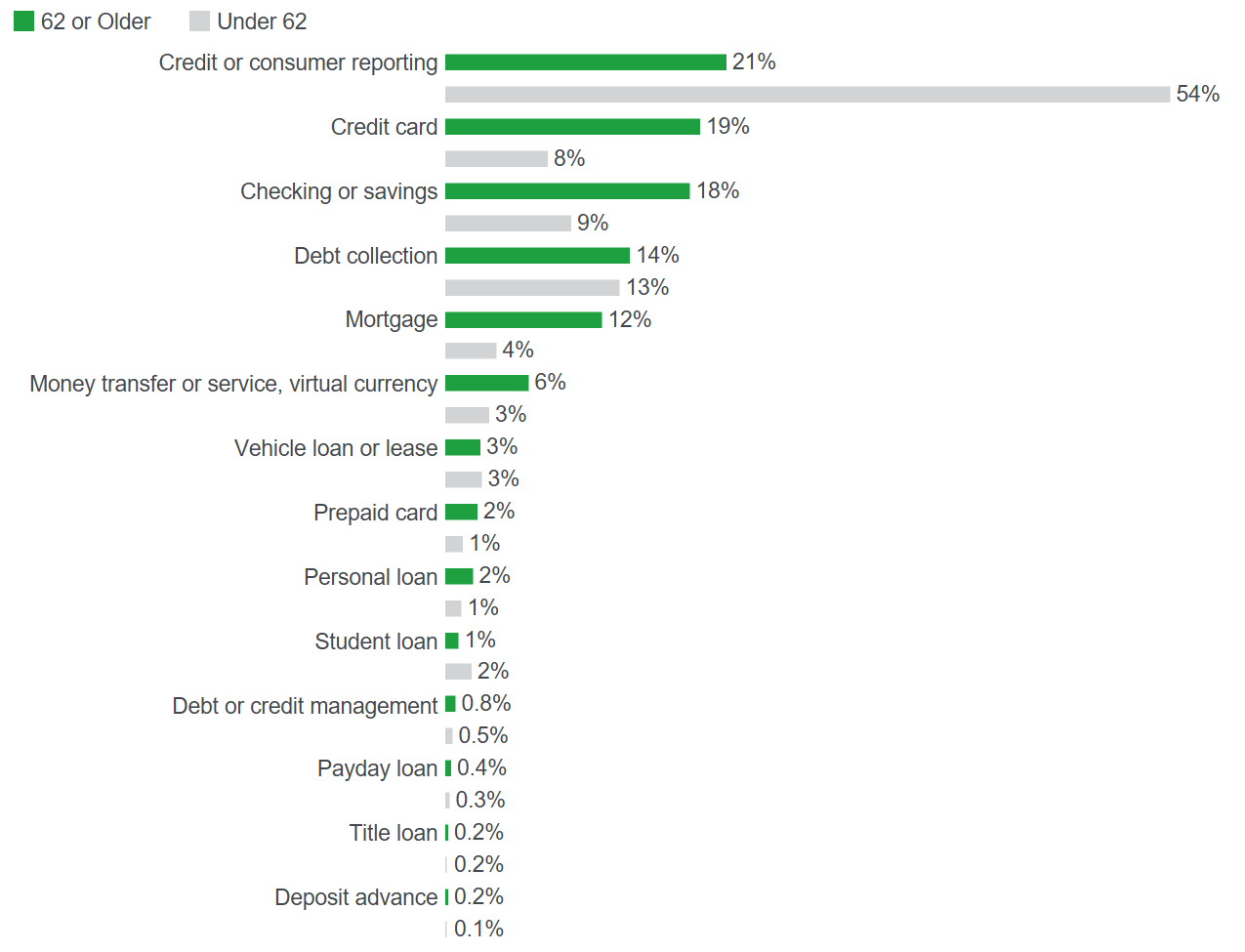

Financial inclusivity continues to be a challenge for older consumers

Consumers provided their age in 332,400 complaints or 20% of all complaints submitted in 2023.

CFPB cautions companies to make resolutions that are accurate and complete

Companies overwhelmingly met the timeliness expectation in their responses to the CFPB. 20% of complaints were closed within the initial response period of 15 days, and 99% were closed within the final response period of 60 days.

Timely responses are essential; however, the CFPB cautions companies against closing complaints too quickly if it harms completeness or accuracy.

Black and Hispanic community's access to financial services is impacted by incorrect Credit or consumer reporting

These concerns about credit access are more prevalent among Black and Hispanic communities, who dispute information on their reports at different rates than non-Hispanic communities.

Consumers expressed concerns about credit access because of errors and inconsistencies in their reports. Some consumers attributed errors on their reports as the reason for being denied credit. For example, some consumers reported being denied credit because there was inaccurate information on their report. Other consumers faced difficulties in securing housing (e.g., rental housing), stating property owners did not approve housing applications because consumers did not pass a required credit check.

Still others reported having to incur greater costs (e.g., high insurance premiums, less favorable credit terms) because of errors on their reports.

Consumer complaints related to identity theft have been steadily rising

Consumers submitted complaints regarding credit inquiries, namely, alleging that they were unauthorized or the result of fraud. Consumers reported attempts to dispute these inquiries previously. CRAs' responses typically stated that these inquiries were a factual record of file access and would remain on their report for two years.

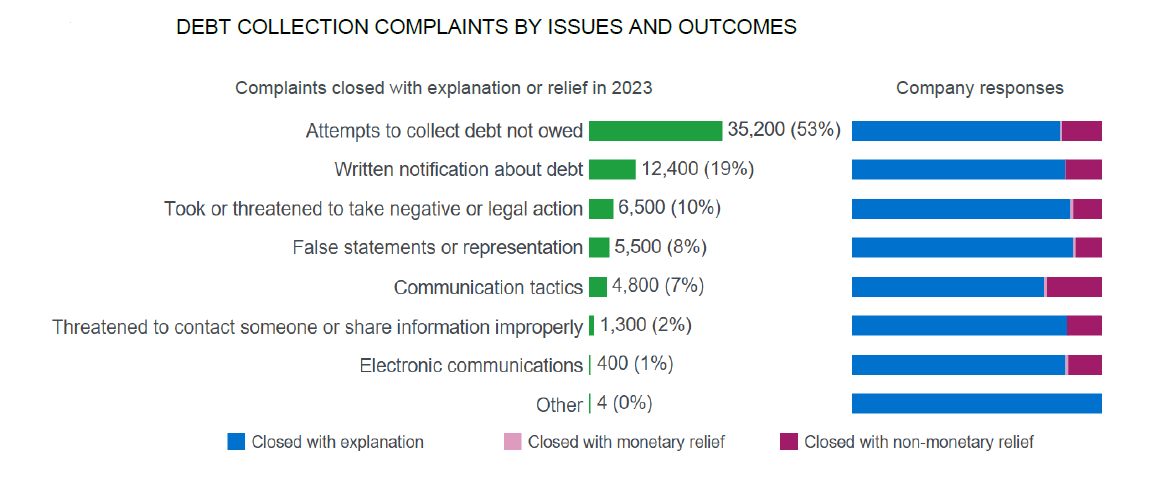

Debt collection continues to be the major area of customer friction

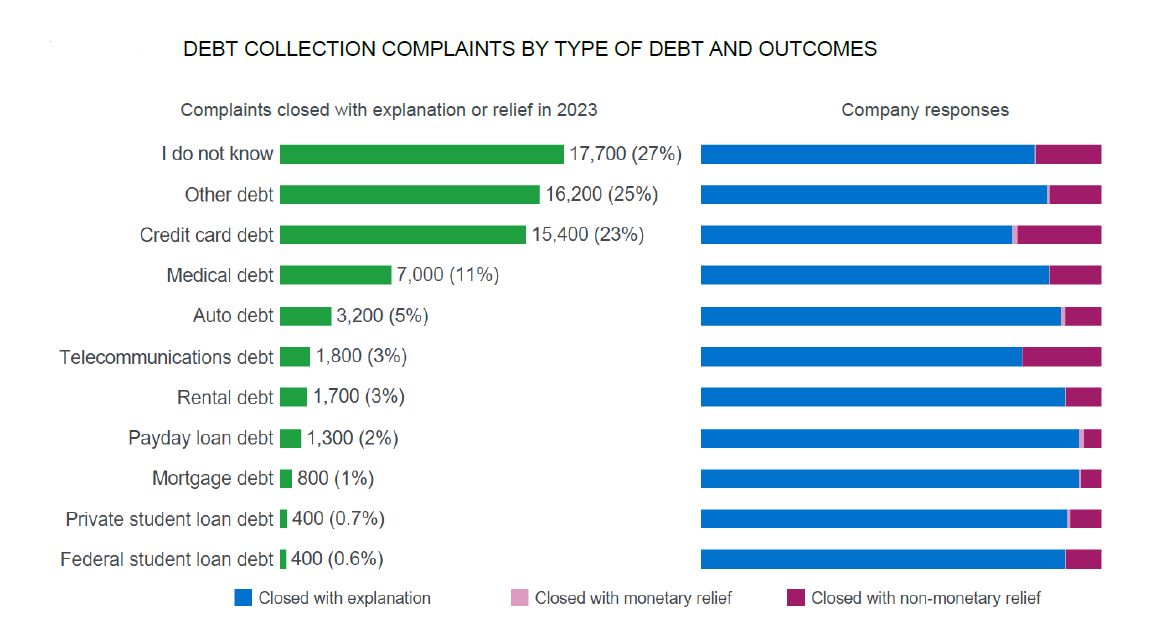

The CFPB received approximately 109,900 debt collection complaints in 2023. The CFPB sent 69,600 (63%) of these complaints to companies for review and response, referred 28% to other regulatory agencies, and found 9% to be not actionable.

The most common issue was Attempts to collect debt not owed.

Consumers also reported that debt collectors called them outside permitted hours (before 8 am or after 9 pm local time) or called them too often. Consumers often characterized these communications as harassing or abusive. Most companies maintained that their calling practices conformed with applicable requirements. In some cases, debt collectors would add the consumers’ phone numbers to their do-not-call lists.

When submitting debt collection complaints, consumers specify the type of debt. In 2023, I do not know and Other debt (e.g., phone bill, health club membership, utilities) were the top two most common complaints by type.

Complaints about general-purpose credit cards or charge cards require a holistic approach in reducing complaints or driving better customer experience

Complaints about general-purpose credit cards or charge cards had the greatest change in volume, increasing 76% from the monthly average of the prior two years.

In these complaints, consumers said there were inaccurate or unauthorized charges on their credit card statements, some due to disputes with merchants and others from fraudulent charges. In some complaints, consumers were told to expect permanent or temporary credits, some of which consumers reported were not given. Other consumers were told they were responsible for charges even though no product or service was received.

Consumers complained about challenges receiving promotion benefits on time or at all. Finally, consumers complained that companies closed their accounts without notification or explanation.

Complaints about savings accounts increased by 80%

In their checking and savings complaints, consumers most often complained that funds were taken from their accounts through unauthorized or fraudulent transactions. These transactions often involved peer-to-peer platforms. Companies often denied claims that transactions were unauthorized or fraudulent and stated that consumers authorized transactions through passcodes or responses to text message alerts.

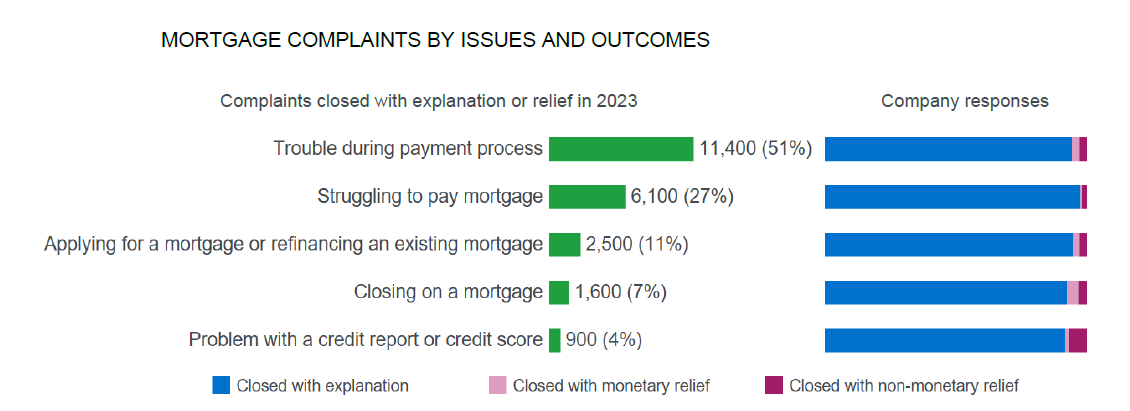

Trouble during the payment process is the most common cause of Mortgage complaints

In 2023, the monthly average for the top issue, Trouble during payment process, decreased 1% compared to the monthly average for the prior two years. Issues related to purchasing a home (e.g., applying for a mortgage or refinancing an existing mortgage; closing on a mortgage) also decreased. This decrease is likely due at least in part to inflation and the rising costs of homeownership, which have had a significant impact on housing sales.

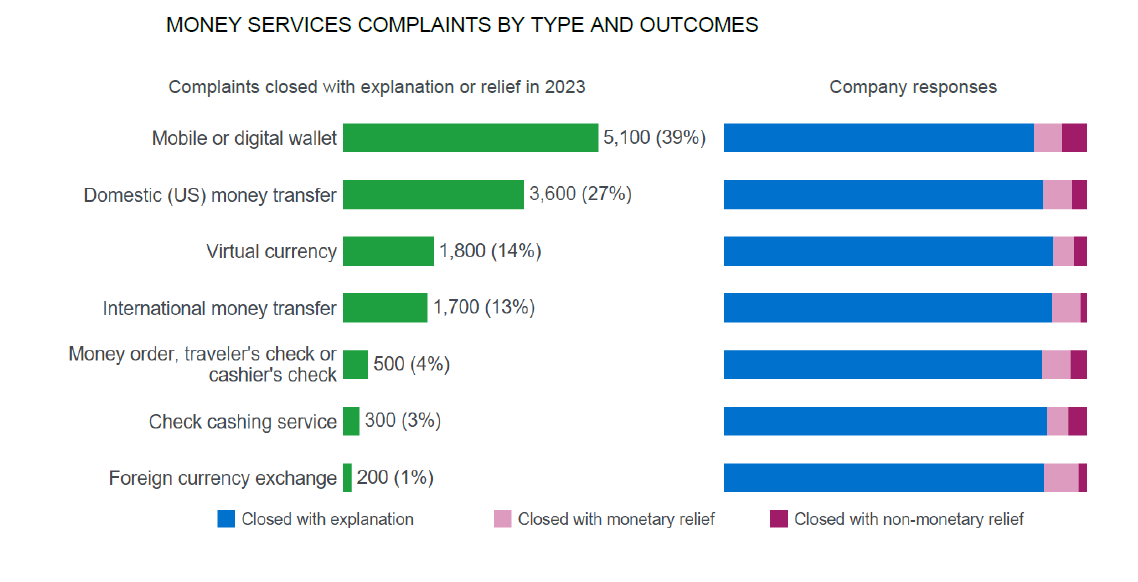

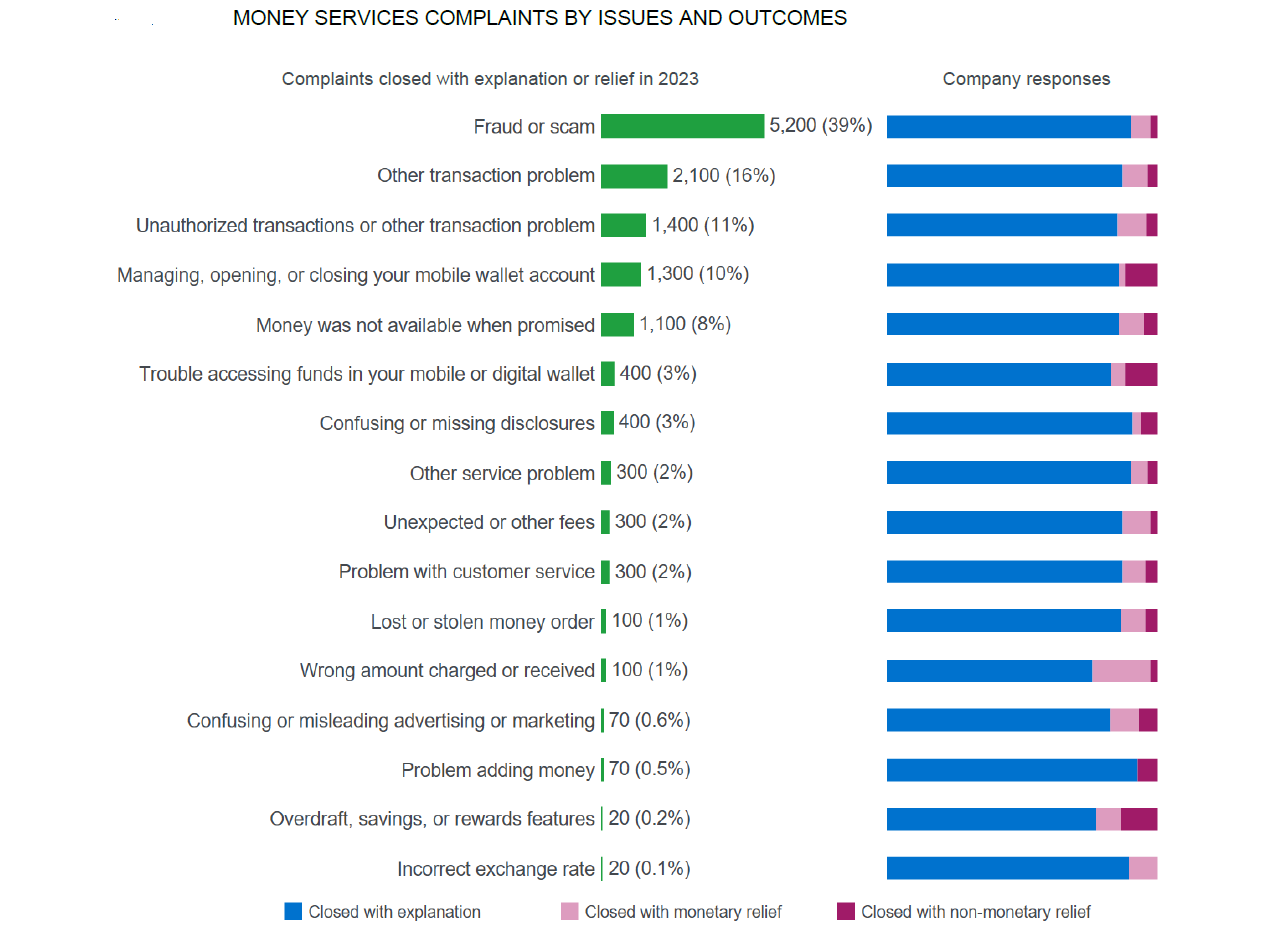

In payments, mobile or digital wallets was the most complained about type of product

Consumers also identify the issue that best describes the problem they experienced. The most common issue was Fraud or scam.

Fraud and scams related to virtual currency continue to drive money services complaints. Consumers reported being frequently deceived into transferring funds through various scams. One common way users fell victim to scams occurs when imposters posing as representatives of investment firms or financial institutions contact them. In response to these complaints, companies frequently emphasized the irreversible nature of blockchain transactions, highlighting that once a transaction is completed, it cannot be undone.

Digital wallet users also complained about being defrauded when attempting to buy goods or services from unfamiliar individuals. Some users incurred losses while attempting to secure apartment rentals in highly competitive markets. In response, companies often emphasized that their services are primarily intended for personal use and do not offer buyer or seller protection programs.

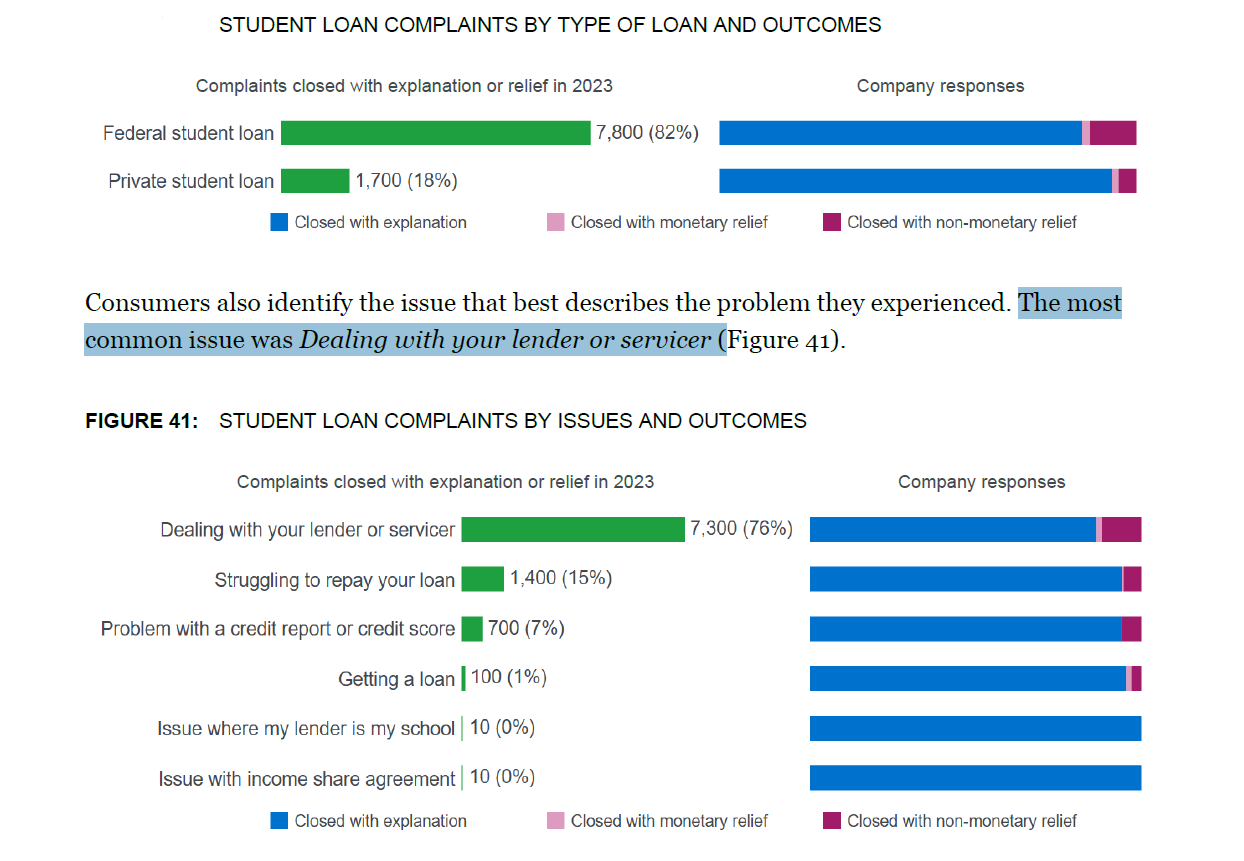

For student loan-related complaints the most common issue was Dealing with lender or servicer

The CFPB received approximately 12,000 student loan complaints in 2023.

Complaints about federal student loans increased 87%, while complaints about private student loans decreased 2%. The increase observed in October 2023 was largely driven by the end of the pandemic-era payment pause for borrowers with federally held student loans.

Consumers reported persistent difficulties in accessing customer service. Many consumers experienced extremely long wait times to access a representative, whether by live chat, telephone, or email. Some wait times were upwards of several hours. It seems many firms still does not have systems and processes in place to handle peak customer service demands.

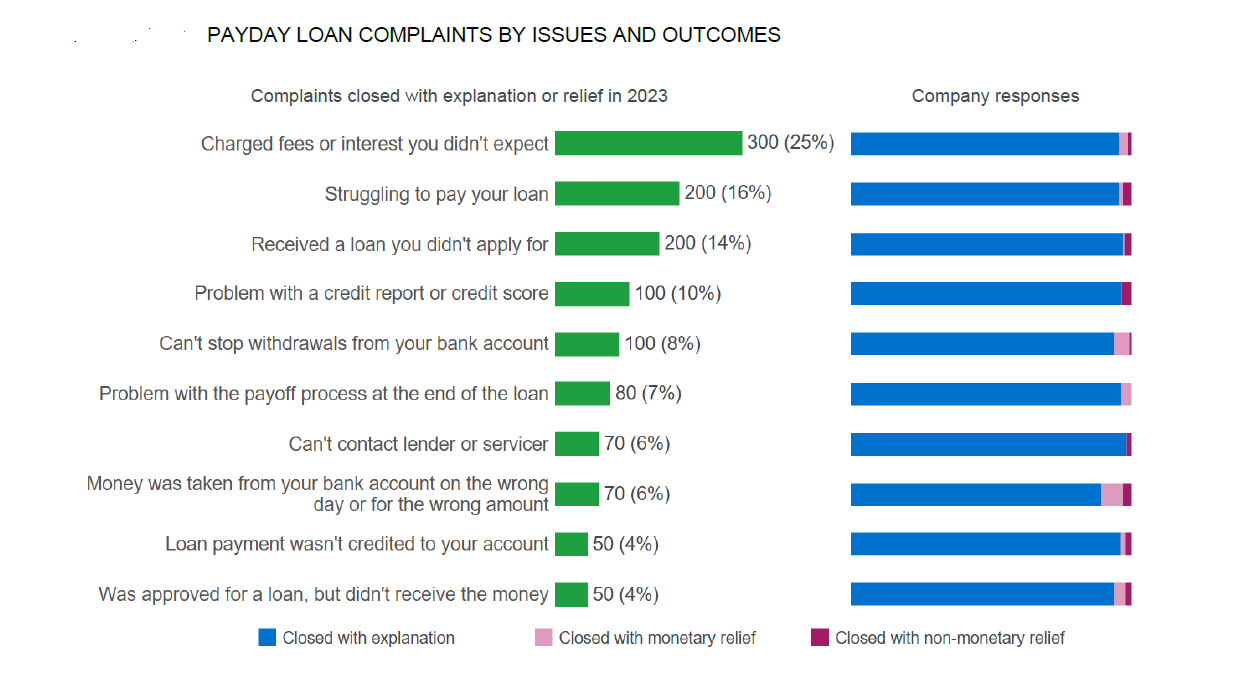

Charged fees or interest is the most common dispute for payday loans

In their complaints, consumers often stated that they did not realize until after taking the loan how high the interest rate was, or that they were being charged fees or interest they did not expect. In some of these complaints, borrowers sometimes stated that none or very little of their loan payments had gone toward the principal. Consumers sometimes also stated that they felt the company’s practices were predatory or violated state laws.

Communication and disclosure are huge areas here for improvement.

The CFPB will continue monitoring complaints, and how companies respond, to meet its statutory obligations and to ensure that consumers remain at the center of its policymaking efforts

The CFPB uses this information to monitor risk in financial markets, assess risk at companies, and prioritize agency action. The CFPB makes complaint data and analyses readily available to CFPB staff to support their supervisory, enforcement, and market monitoring activities. Additionally, the CFPB makes complaint data available to other federal, state, and local agencies, as well as the public.

Consumers also complained about issues with customer service when seeking to address problems with access to deposit accounts. Consumers stated they experienced long wait times, multiple transfers, and disconnected calls when calling about their inability to make purchases, withdrawals, or transfers.

Companies can similarly use complaint information to gain important knowledge about their business, competitors, and industry more broadly. Consumer complaints can be an indicator of potential risk management weaknesses or other deficiencies, such as violations of laws or regulations. Complaints can reveal a weakness in a particular product, service, function, department, or vendor. Complaints can also identify opportunities to enhance consumers’ experience and understanding of consumer financial products and services.