Dispute Resolution Analysis

The General Insurance Code Governance Committee (CGC), Australia, has recently completed a Thematic Inquiry into Making Better Claims Decisions. Here are some of the key recommendations as a result of this inquiry.

- Identify themes in the data that may explain trends in complaints about denied claims.

- Improve processes and practices based on the insights obtained from data analysis.

- Analyze how deficiencies in processes lead to gaps in compliance with the Code or breaches of the Code.

- Establish metrics and measure the success of the improvements they implement following data analysis.

Identify themes in the data that may explain trends in complaints about denied claims.

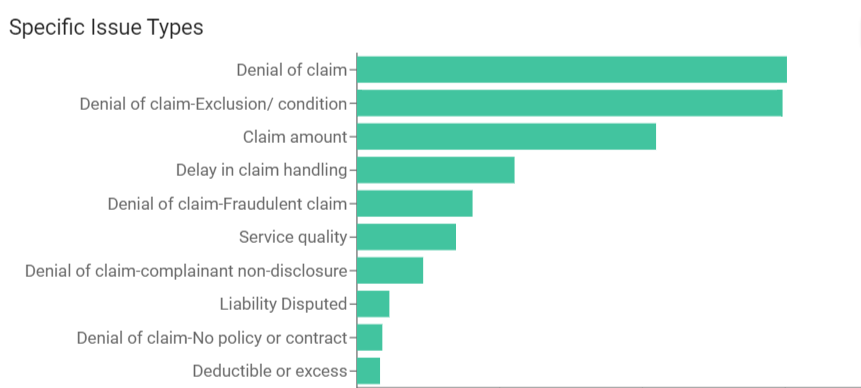

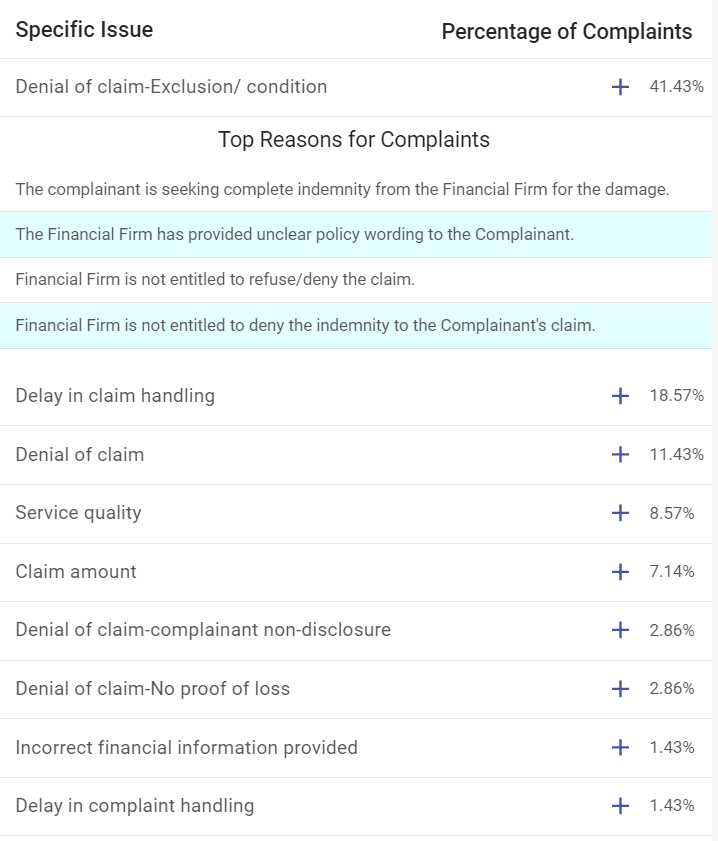

Customer complaints related to claims can provide valuable insights and opportunities for improvement for an insurer. Based on Cognitive View's AFCA insights, for the General Insurance segment, we see the top reason for complaints is "Denial of claim." So claims are the top reason for disputes.

Identifying themes

Analyze the reasons for claims and claim dispute data from various sources, including claims management, complaints, and customer conversations for example, voice and social media.

Before identifying themes, standardize complaints metadata and KPIs, keeping some best practices in mind. Use the same standards for IDR, EDR, and Claims. AFCA has a good set of standards around this and it helps in IDR reporting.

The idea is to design the system so that it can support both a top level view while supporting the ability to fine grained around it. Themes can be identified starting with understanding the top reasons for complaints for each issue and specific issue type and being able to go deeper in each category.

Leveraging standards means the claims performance can be compared with the industry.

Improve processes and practices based on the insights obtained from data analysis.

Complaint analytics point to product, process, and compliance issues. Implementation of compliance should consider both process and cognitive automation. For example, RG271 implementation should combine a compliant process and AI analytics to be truly effective.

Why should you consider the analysis of complaints using AI and advanced analytics?

Analyzing complaints can reveal recurring issues or patterns. Identifying these trends can assist in understanding the root causes and implementing systemic changes to prevent similar problems in the future.

Claim disputes can highlight potential problems with claim processing. This might include delays in processing claims, lack of transparency, or difficulties submitting necessary documentation. Addressing these issues can lead to a more efficient and customer-friendly claims experience.

Frequent complaints about claim denials or rejections can indicate issues with the company's claim assessment criteria. Reviewing these cases can help identify areas where the claims process can be fairer and more accurate.

Complaints may also point to potential shortcomings in products or services. Feedback from dissatisfied customers can be used to identify areas where improvements or updates are needed.

Feedback from dissatisfied customers and claims handling staff can be used to identify areas where improvements or updates are needed.

Analyze how deficiencies in processes lead to gaps in compliance with the Code or breaches of the Code.

Complaints related to claims can shed light on unclear or ambiguous policy wordings. If customers consistently need to understand specific terms or exclusions, the company may need to review and revise its policy documentation to prevent future disputes.

The following questions are a great way to introspect and looking solutions for

- How well have we embedded compliance requirements like Claims as a financial service and Insurance code of conduct in our processes?

2. Are our sales, post-sales, claims, and complaint processes compliant? How are the expert assessment and the claims value chain integrated with our processes?

3. How well do customers understand our product disclosures? How do we set internal standards and training and improve customer expectations?

4. Do we have monitoring capability for PDS across all our processes, and how well is it integrated into our underwriting process?

5. Do we have analytics to understand the compliance issues from Claims, Complaints, and Customer conversation data?

6. How can I learn about compliance issues in real-time and remediate them?

Establish metrics and measure the success of the improvements they implement following data analysis.

The analytics may provide insights into Claim Processing Issues, Policy Ambiguities, Claim Denials and Rejections, Pattern Identification, Product or Service Improvements, and Compliance Concerns.

Setting up learning and continuous feedback loop based on the standards and best practices should be considered.