Delays in insurance claims

Royal Commission’s final report recommended that insurance claims handling should not be excluded from the definition of ‘financial services’, reflected issues arising from a number of case studies examined. In general insurance, as demonstrated by several case studies, poor conduct included:

- Failing to handle claims in a fair and transparent manner, failing to act in an efficient, professional and practical manner, and breaching the insurer’s duty of utmost good faith;

- Delays in claims that resulted in consumer detriment. The cause of the insurer’s poor conduct was “was largely attributed to its internal systems and processes for handling claims and dispute arising from those claims”.

Further, the Commissioner highlighted several instances where insurers fell below community standards and expectations, these included:

- Implementing an inadequate system to train case managers and inadequate systems to oversee the actions of case managers; and

- A lack of robust systems to avoid potential conflicts of interest; and

- A failure to have adequate systems in place to ensure that its Internal Dispute Office conducted a robust analysis of declined claims, in a way that was independent of the claims team; and

- A failure to engage with external dispute resolution in a frank and cooperative way

Proposed regulatory change to support claims as a financial service

In implementing the Royal Commission’s Recommendation 4.8, Treasury proposes a two-pronged approach:

1. Remove Regulation 7.1.33; and

2. Use existing legislative powers to define the activity of handling or settling an insurance claim as a ‘financial service’ for the Corporations Act’s purposes.

The proposed regulatory change applies to insurers and third-party representatives of insurers that provide claims handling service.

The requirements that could apply differently depending on the type of advice provided (general versus personal) and the insurance product. Examples of provisions that could apply include:

- general obligations on an AFS licensee that apply to the financial services that it provides;

- providing a Financial Services Guide;

- general advice warnings;

- conduct obligations (which apply to the provision of personal advice to retail clients);

- conflicted remuneration;

- providing a Statement of Advice when providing personal advice to retail clients; and

- training obligations.

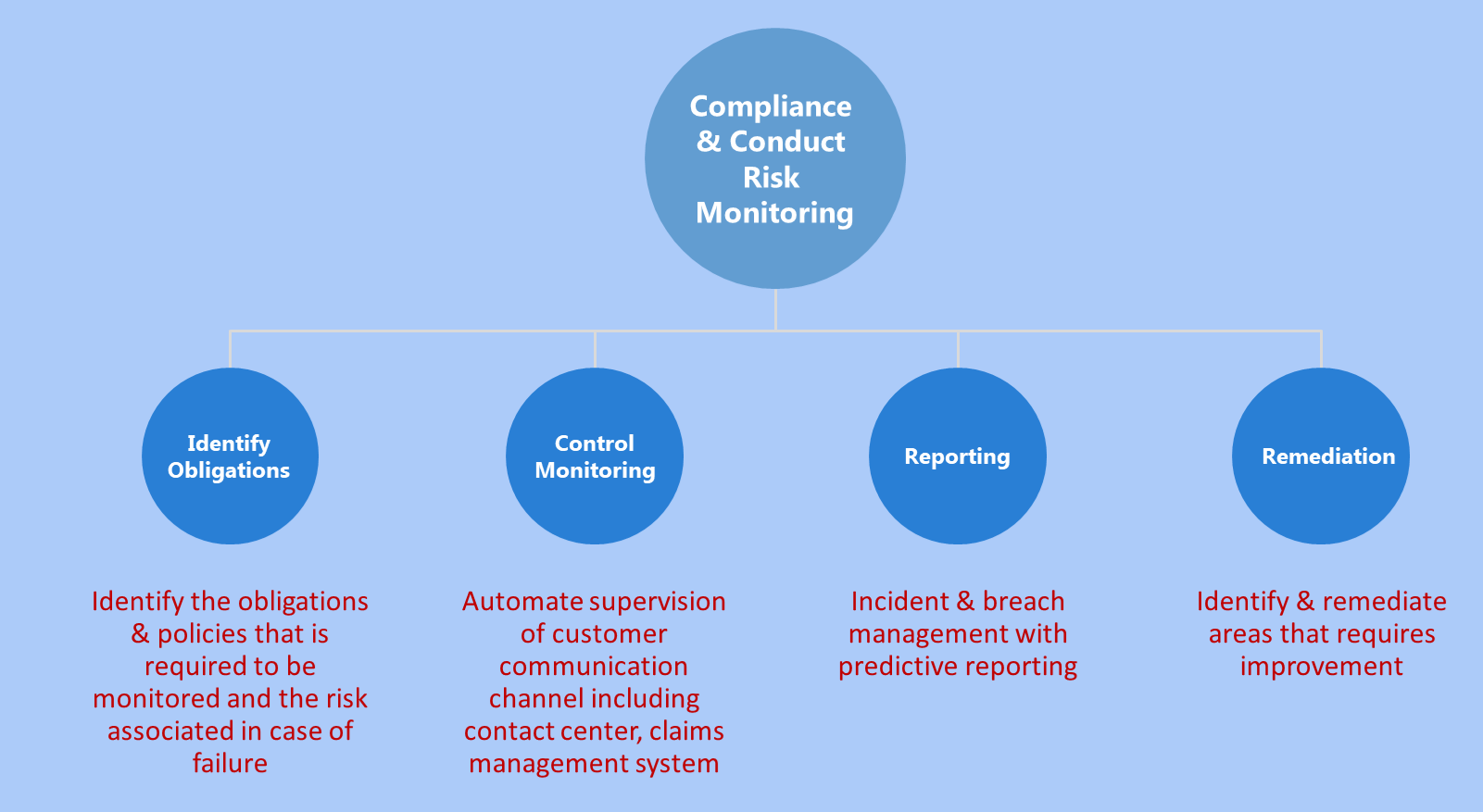

Supervision in the claims decision-making process reduces unsubstantiated claim rejections and discrimination. To support compliant claims process and fair customer outcomes AI & Big data analytics can provide appropriate oversight and transparency mechanisms. A systemic approach is required to establish compliance and conduct risk for adequate supervision.

As a first step, establish and document the system of internal controls and processes that requires supervision. The supervision process should include the complete customer engagement lifecycle depending on the compliance requirement and the role the entity plays in the value chain. This may consist of sales, support, claims, complaints.

One of the significant causes of claim-related disputes is information asymmetry and customers not meeting disclosure requirements which can be avoided in the policy sales by agents with improved supervision. Below are some of the critical steps in establishing a compliance and conduct risk management process.

- Identify Policies & Obligations: An effective internal controls system typically includes a centralized documented inventory of key processes and policies and of the controls. To support a risk-based supervision model, identify risk for each of the compliance and conduct requirements. Since Insurers will anticipate risks from customer’s day-to-day communication monitoring, consider the impact of the changes in risk dynamics.

- Control Automation: Review manual supervision process. Augment the manual process with AI-based automation. Improve operational model to support risk automation strategies.

- Reporting: Enable incident and breach management with continuous control monitoring to support the predictive decision-making process

- Remediation: Support an ongoing improvement process with risk mitigation strategies