Key attributes of financial products

ASIC’s RG 274 Design and Distribution Obligations (DDO) introduces a new category of obligations concerning the design and distribution of financial products. This is a profound change, making product issuers and distributors directly responsible for ensuring products are generally only sold to the intended target markets. It is a reversal of the long-established principle of ‘let the buyer beware’ — now, it is the seller who is at risk and must beware. So simply publishing 100 pages of the disclosure document is not enough. A customer-centric approach is required to support the target market and to meet the appropriateness requirements.

Appropriateness requirements

The target market determination (TMD) must also meet “appropriateness requirements”. It would be reasonable to assume that it would meet their needs and objectives if it was distributed to the specified consumer group. To satisfy the appropriateness requirements, the TMD must include sufficient information to reasonably conclude that:

(a) the product, including its key attributes, is likely to be consistent with the likely objectives, financial situation and needs of consumers in the target market; and

(b) the distribution conditions make it likely that the consumers who acquire the product will be in the target market.

Unlike personal advice, the design and distribution obligations do not require an issuer to assess products’ suitability for the circumstances of individual consumers. Instead, the obligations require issuers to develop products. Those products (including their key attributes) are likely to be consistent with the likely objectives, financial situation, and needs of the class of consumers to whom the products will be distributed.

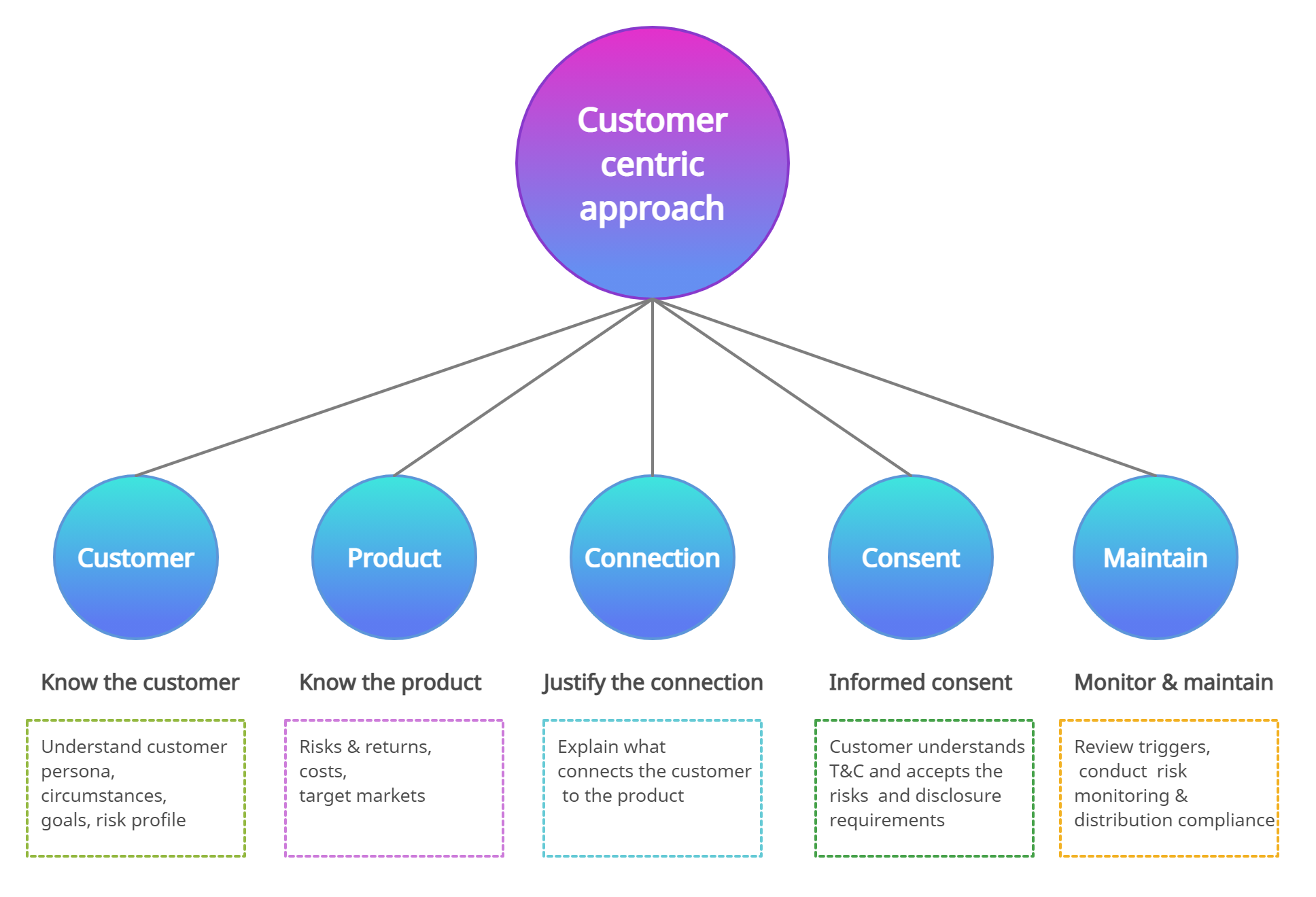

The two key principles of DDO are fairness (in designing, targeting and distributing products that meet consumer needs) and a customer-centric approach to the entire product lifecycle. A fair and customer-centric approach is one where target markets are determined so that products offer value to consumers.

Supporting customer-centric approach

A customer-centric approach is a way of doing business that fosters a positive customer experience at every customer journey stage. It builds customer loyalty and satisfaction, which leads to referrals for more customers. Anytime a customer-centric business makes a decision, it deeply considers the effect the outcome will have on its customers.

Knowing the customer provides the right raw data and critical context for analysis, advice, and recommendations.

Knowing a product means much than just knowing its basic characteristics and, roughly, what it does. The distributor’s staff must understand the risk-return and volatility potentials within a product, increasingly leading to a requirement to designate an intended target-market for that product.

Justify the connection or appropriateness means there are reasoned, logical arguments to support the recommendation, strategy or product sale — based on the agent or adviser’s understanding of the client and their knowledge of the available products. What is considered appropriate can, quite rightly, vary from person to person.

Informed consent means the customer understands the T&C and full knowledge of not meeting disclosure requirements.

Suitability is established at a point in time — but it is not static. It needs to be periodically re-established, as the individual and the financial products each change over time. Identifying any changes in the product or customer that could affect the suitability of the current arrangements.