Supporting claim disputes with AFCA Insights

Learning from claims related recent dispute trends

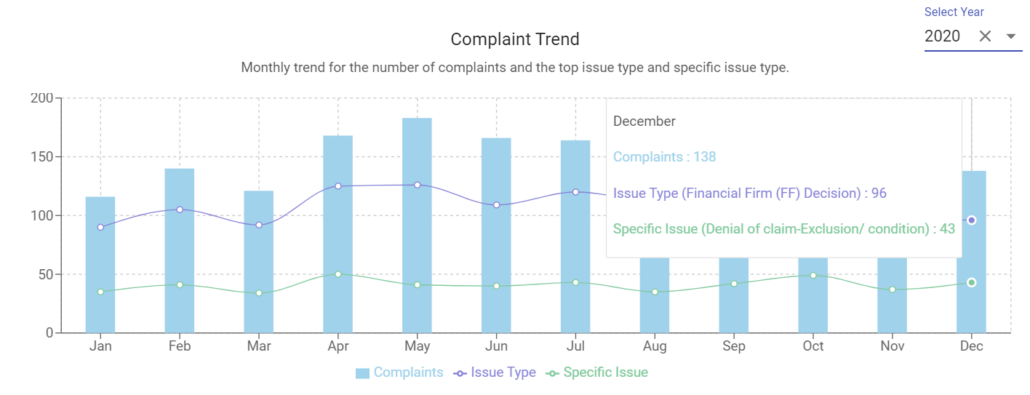

If we look at some of the complaint trends we can observe recent claim related dispute trends.

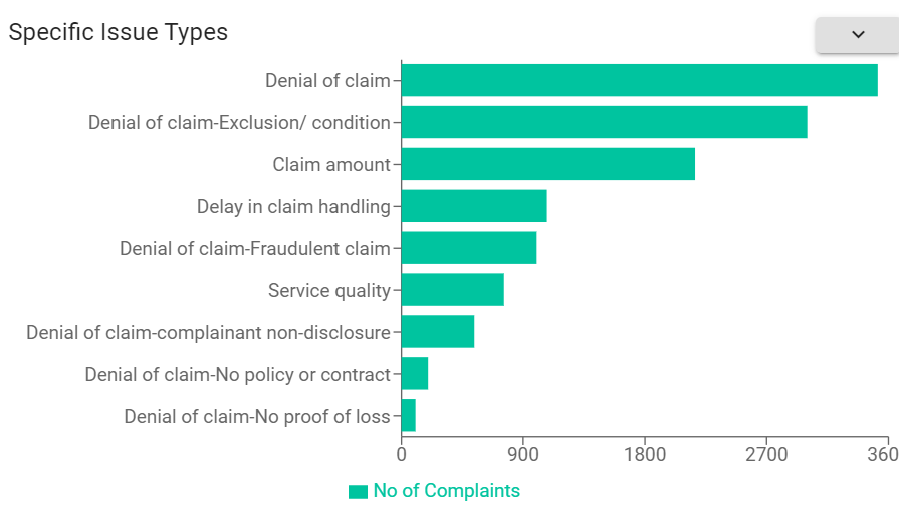

Top issues for claims dispute

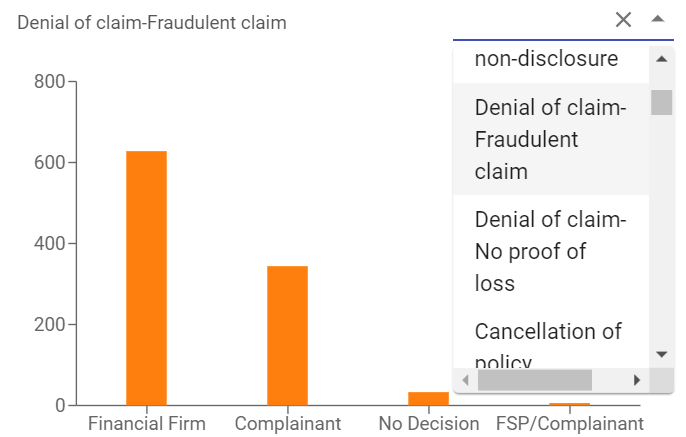

AFCA’s decision outcome for fraudulent claims

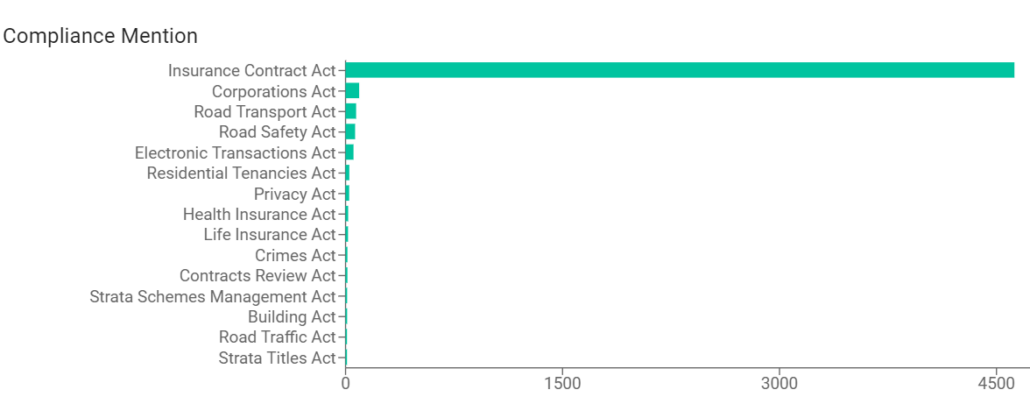

Insurance contracts act is the top compliance failure reason for claim related disputes

Resolving claim disputes with Insurance Contracts Act

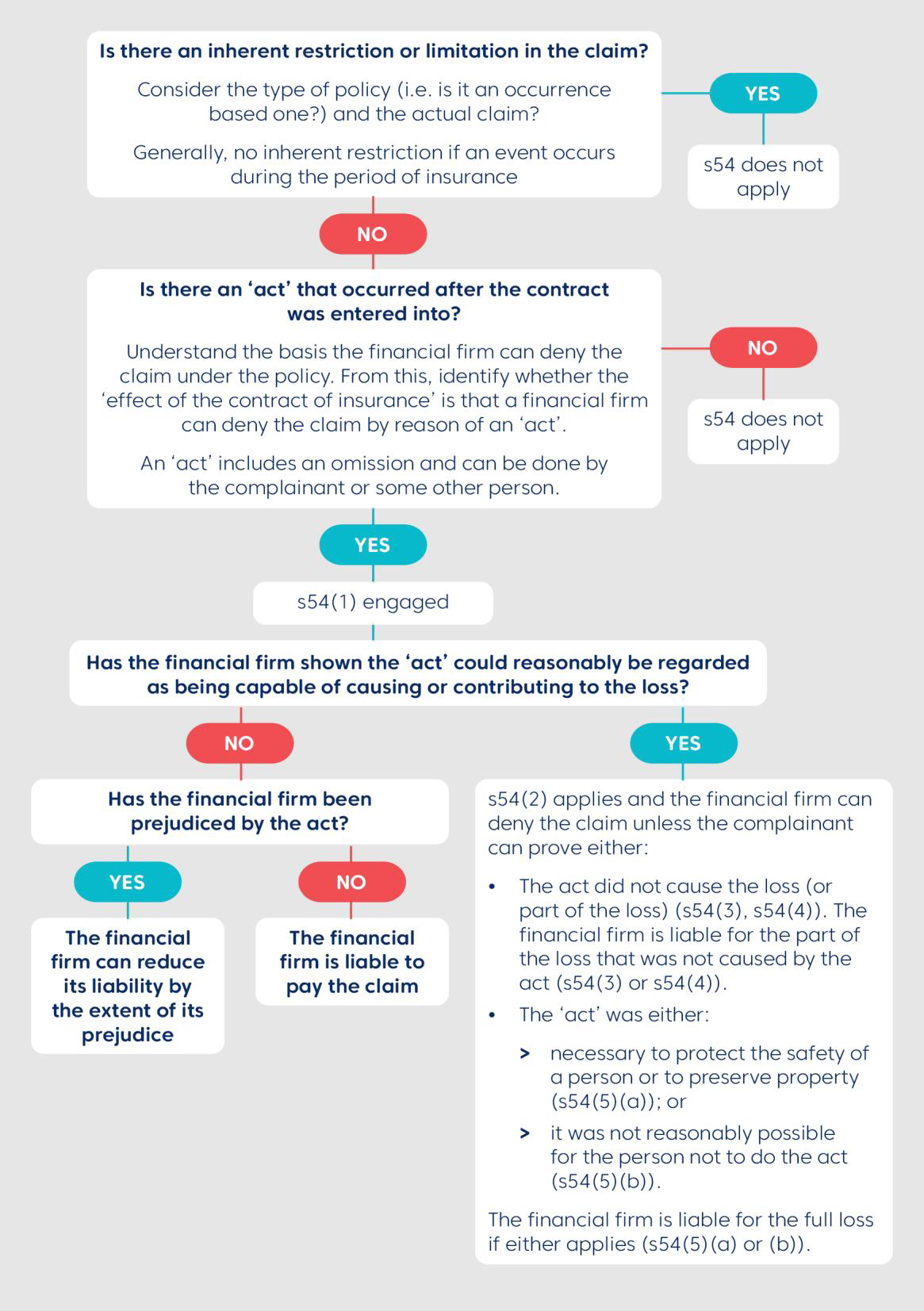

AFCA’s approach document “The AFCA Approach to section 54 of the Insurance Contracts Act” is a guideline for firms to understand how they can resolve claim related disputes and support an efficient IDR & EDR processes. Section 54 is a remedial provision and aims to strike a fair balance between the interest of an insurer and an insured with respect to a contractual term designed to protect the insurer from an increase in risk during the period of insurance cover.

When considering a complaint and the application of section 54, AFCA determines the complaint on the basis of what is fair in all the circumstances having regard to the relevant legal principles, the terms of the policy, good industry practice including relevant industry codes and prior AFCA or predecessor scheme decisions.

Below approach outlines how AFCA evaluates and applies section 54 of the Insurance Contracts Act 1984 to insurance complaints

Learning from AFCA’s definition of complaint and resolution approach is a great way to learn and apply section 54.

When applying section 54 to complaints, AFCA will ask

- What are the inherent limitations and restrictions within the claim?

- Is there an act or omission that occurred after the contract was entered into that the financial firm is relying upon?

- Could the act reasonably be regarded as being capable of causing or contributing to the loss?

- If yes, was the act either:

- > necessary to protect the safety of the person or preserve property or

- > could not reasonably be avoided?

- If no, has the financial firm been prejudiced by the act, and what is the extent of the prejudice?

Some of the above questions help in determining the scope and in identifying the search criteria’s to find similar disputes from the past using AFCA Insights

- Identify keywords

- Identify metadata like Issue, Category, Product, Specific issue, etc.

- Compliance

- Similar companies

- Decisions outcome

- Timeframe

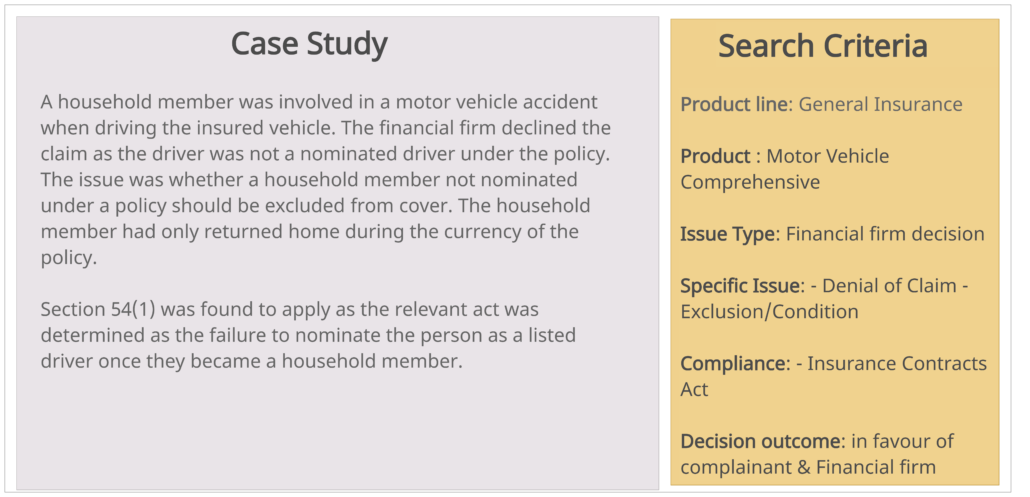

How is this applied in practice?

Above is a real case study (315503) and as there was no evidence that driver was not an acceptable risk or would not have been insured by the financial firm if nominated there was no prejudice to the financial firm. FOS, the predecessor of AFCA found in favour of the complainant.

Sign up here for Cognitive View’s AFCA Insights (Sign up here)

Who can use AFCA Insights tool?

- Financial firms, consumers and consumer representatives who have an insurance complaint at AFCA involving technical policy exclusions.

- Lawyers and other professionals who are assisting the insurance claims process.

- Anyone who wants to understand how AFCA applies legal principles, industry codes and good industry practice when considering insurance complaints involving s54.

Here is a full list of AFCA complaint resolution approaches.

https://www.afca.org.au/what-to-expect/how-we-make-decisions/afca-approaches