Customer expectations in claims processing

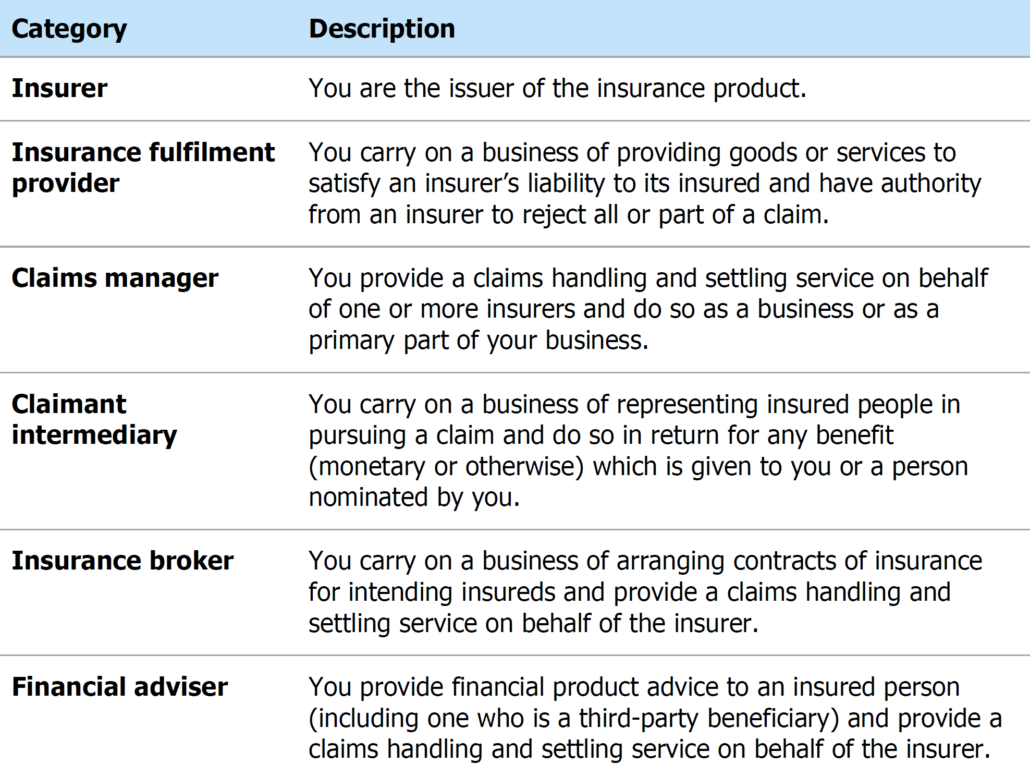

Previously, claims handling and settling services for insurance products were excluded from the definition of a ‘financial service’. This exclusion was removed as part of the Government’s response to the final report of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

From 1 January 2022, if you carry on a business in Australia of providing claims handling and settling services and you belong to certain prescribed categories, you must hold an AFS licence authorising you to provide such services (a ‘claims handling authorisation’) or be authorised by a person who holds claims handling authorisation (unless an exemption applies).

Who is this relevant to?

Some of these changes introduce multiple challenges in operational risk management. Customers’ expectations in terms of turnaround time, and omni-channel access continue to increase. Further, increase of compliance burden will continue to erode profitability. Claims processing involves several managerial, administrative and customer service functions that perform information-intensive manual tasks to protect the company against fraud or compliance errors.

Compliance is a necessity as new policies and regulations are constantly being introduced, making it difficult to keep up with changing regulations while executing efficient processes.

With the company’s standards of service and its commitment to customers at stake, the scope for errors is next to none and the price of accurate claims processing cannot be underestimated. There is a greater need to consider automation to combat these challenges.

Claims Process Automation

The insurance-claims journey—from prevention to loss notification, to assessment, to handling and settlement—has historically been opaque and confusing to customers. They have paid in advance for an abstract product, a policy to defend against risk, and at the “moment of truth” when they want to recoup a loss, they are faced with a complex, cumbersome, often very time consuming and iterative process.

Claims processing is much data and document-intensive. It needs you to collect a vast amount of information from varying sources. A claim process that is manual and lengthy can create trouble for both customer service and operations.

RPA is a process automation technology that can help the insurers in easily gathering data from various sources to be used at the centralized documents so that the claims can be processed in a much faster pace. What’s required is process automation technology that enables companies to scale human decision-making and apply it to use cases that involve hundreds of thousands of complex documents consisting of long-form text, tables, images and more. Dealing with this unstructured data is where the real opportunity lies in terms of achieving true effectiveness of the process automation.

As part of the new regulatory requirements, a detailed review of the claims value chain should be conducted to identify who may be captured, for what activities, and how they will identify, communicate with and ultimately train and supervise those who are their representatives. This will mean that additional compliance requirements may apply to small businesses such as smash repairers and builders, who will be largely unprepared for higher levels of oversight.

Supervision & Communication Monitoring Automation

Below are some of the areas where supervision and communication monitoring can be used to support Insurance claims handling as a financial service.

Claimants experiencing vulnerability or financial hardship

The vulnerability may arise from a range of factors such as age, disability, mental health, physical health, family violence, language barriers, literacy, cultural background, Aboriginal or Torres Strait Islander status, remote location or financial distress. To address these gaps companies need to establish policies and conduct guidelines to handle and settle claims efficiently, honestly and fairly, but also making it mandatory to use it as a foundation for control automation. Insurance industry codes provide useful indicators of what industry considers to be appropriate strategies for dealing with consumers experiencing vulnerability. These include:

- recognise a person’s vulnerability

- identify factors that contribute to vulnerability in your policyholders and how you will tailor the claims process for the needs of those consumers

- training your representatives on how to proactively identify if a person is experiencing vulnerability or financial hardship, and not rely on a person to self-identify this

- ensuring your representatives are trained on your policies and that you monitor compliance with those policies

Although training of staff is already part of many organization’s processes, organizations find consistent gaps in adherence to these policies. Incentives and performance measurements for claims handling staff and management creates conflicts of interest, so continuous review is required for the adequacy of these processes.

Code membership

Industry codes typically set out obligations for subscribers about:

- completing stages of claims handling and settling within certain timeframes

- making relevant requests for information

- explaining the claims process to claimants, keeping them informed during claims assessment, outlining reasons for decisions and how to access dispute resolution, and

- identifying and responding to consumers who are experiencing vulnerability or financial hardship.

The relevant insurance codes of practice are:

- Life Insurance Code of Practice

- Insurance in Superannuation Voluntary Code of Practice

- General Insurance Code of Practice, and

- Insurance Brokers Code of Practice.

It is important to establish internal processes and guidance for staff and will monitor compliance with these processes based on relevant industry’s code of practice. Monitoring the code compliance will ensure claims are handled efficiently, honestly and fairly with the service standards and timeframes.

Compliance

As part of the AFS licensee requirements to satisfy this obligation, there is a need to handle and settle insurance claims:

• in a timely way

• in the least onerous and intrusive way possible

• fairly and transparently, and

• in a way that supports consumers, particularly ones who are experiencing vulnerability or financial hardship.

It is possible that many claims service suppliers and other agents acting on behalf of insurers may seek to become authorised representatives of insurers rather than going through the process of obtaining their own AFSL. Insurers will need to consider their obligations to train, monitor and supervise the conduct of such authorised representatives, and the significant additional compliance that may entail. Leveraging technology to automate the supervision process will help in

- verifying compliance and detect any non-compliance (e.g. which obligations have breached and monitor key indicators of quality and performance)

- investigate, assess and escalate reports of non-compliance

- deal with non-compliance (e.g. train the representative, change processes to ensure future compliance and monitor processes to ensure they are operating effectively), and

- remediate claimants who have been harmed by the non-compliance (e.g. refer the claimant to another representative), regardless of whether or not the claimant was aware of the non-compliance.

Dispute Resolution

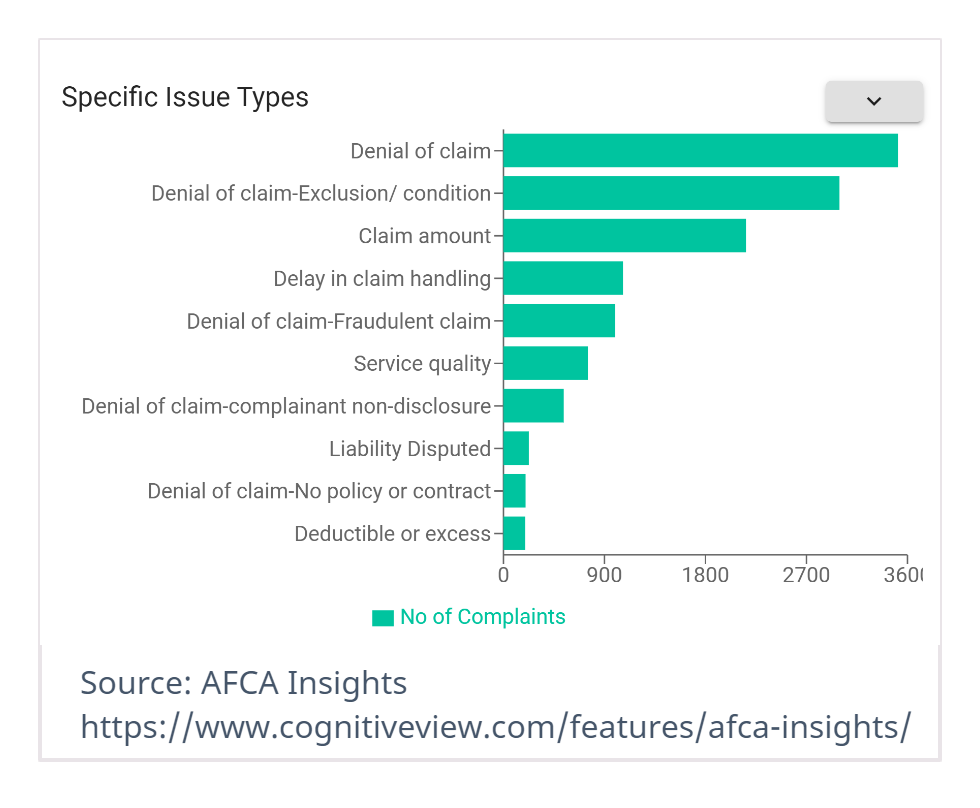

Below are some of the top disputes for claims lodged at AFCA(Australian Financial Complaints Authority). Denial of claim is one of the top dispute issues in the General insurance category.

Denial of your claim-related disputes may happen based on a variety of reasons. For example, it could be based on non-disclosure of a pre-existing condition or exclusion; driving under the influence; where loss or damage occurred as the result of a breach of the insurance policy or an excluded event (such as flood where flood is excluded); where the claim is alleged to be false or fraudulent; where the policy is claimed to be lapsed or cancelled; where you have been unable to prove that the loss has occurred or that the goods damaged or lost were yours.

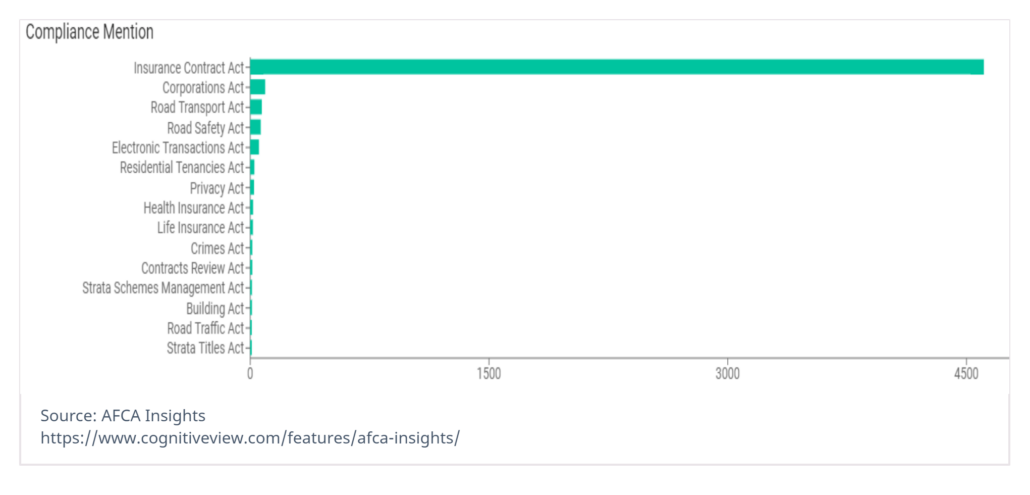

Many firms have invested in CRM/Complaints management technologies and established dispute resolution processes. Identifying customer concerns & complaints early in the claim process provides insurers with an opportunity to resolve before it gets escalated to AFCA. Setting the right expectations with the customer and proactive communication also creates a good claims experience. Compliance needs to be considered as part of the claims process. Below are some of the top compliances mentioned in AFCA’s claim related disputes.

Decision-making process for complex claims and claim-related disputes supported by external data sources like AFCA Insights gives an opportunity for claim assessor and IDR team to make the right decisions but learn from others.

Risk-Based Supervision

Risk-based supervision is largely outcomes and principles-based compared to a compliance-based approach. It seeks to assess, within a forward-looking perspective and making extensive use of judgment, the most important prudential and conduct risks posed by firms to supervisory objectives and the extent to which firms are able to manage and contain these.

Supervisors are mostly resource-constrained and requiring them to prioritize a variety of code compliance & conduct related activities rigorously. Risk-based supervision increases the effectiveness of compliance while increasing efficiency through improved resource allocation and processes. It assists in prioritization of resources to the areas of greatest conduct risk. Risks are not eliminated, but supervisors are able to address them in the most efficient and effective way of pursuing their objectives. This allows banks to address the risks in a systematic manner giving priority to what matters most.

Contact us (sales@cognitiveview.com) to schedule a time to discuss below

- Strategy whitepaper control automation to support Insurance claims handling as a financial service

- AFCA Insights integration with Claim management and IDR systems for dispute resolution

- Demo